This job is OPEN to APPLY for ALL Nationalities, unless otherwise specified.

We have an immediate full-time opportunity for a driven Commercial Real Estate (CRE) Loan Processor & Closer with a desire to grow professionally.

The CRE Loan Processor & Closer will primarily be responsible for working directly with the borrower’s loan representative(s) to obtain the necessary borrower, guarantor, and property information to prepare the loan file for underwriting and closing, works with third-party vendors to obtain satisfactory reports and coordinates loan closing with legal counsel. The Loan Processor & Closer also performs basic financial statement analysis and assists with data entry for credit decisions.

As part of the AVANA team (www.avanacompanies.com), we will provide you training in U.S. real estate lending and pair you with experienced U.S.-based team members to ensure you have the support needed to succeed.

We will train you to provide great customer service and build strong client relationships, following AVANA’s core values: Putting People First, Doing the Right Thing, Taking the Lead, Making an Impact, and recognizing that Excellence is a journey.

Duties and Responsibilities

Collection of Borrower and Property Information (40%)

- Provides excellent customer service to Business Development Officers (BDOs), borrowers, underwriters, and other loan stakeholders.

- Works directly with the loan representative to obtain the necessary borrower, guarantor, and property information for the loan file.

- Works with third-party vendors to obtain reports, such as appraisal, environmental, title, credit, property condition assessment, engineering, and others as needed.

- Prepares and distributes correspondence to others involved in the loan transaction.

- Ensures items are received and reviewed in a timely fashion to support an expedient loan process for all involved.

Verification of Loan Information (10%)

- Maintains the integrity of the loan file by ensuring that information provided is complete and accurate.

- Ensures that documentation contains the appropriate signatures.

- Reviews borrower information for consistency.

- Follows up on items that require additional action.

- Interprets file contents in an effort to anticipate problems that would otherwise arise in underwriting.

- Applies independent judgment to proactively take action on leading indicators and “red flags” to ensure potential problems are resolved as early as possible in the lending process.

Loan Closings (50%)

- Verifies that all required loan and credit committee approvals are obtained.

- Acts as the primary point of contact between the borrower, lender, external counsel, title companies, and escrow agents.

- Coordinates and manages the collection of due diligence materials, such as title searches, appraisals, environmental reports, surveys, and zoning verifications.

- Maintains consistent communication with BDOs, underwriters, and credit analysts to ensure smooth progression towards closing.

- Works with external legal counsel to ensure timely preparation of loan documents, including promissory notes, mortgages, deeds of trust, security agreements, and guarantees.

- Reviews drafts of loan documents for accuracy, ensuring compliance with lender policies and legal requirements.

- Serves as a liaison between legal counsel and internal teams (e.g., underwriting, compliance) to address any document-related concerns.

- Ensures external counsel reviews and approves title commitments and ensures all necessary endorsements and policies protect the lender’s interest.

- Liaises with external legal counsel to resolve complex title, insurance, or compliance issues.

- Works with internal and external teams to clear any exceptions (e.g., title or insurance issues).

- Coordinates with title companies and escrow agents to ensure all necessary documents are ready for closing.

- Ensures all pre-closing conditions set by the underwriting team are satisfied before the loan is approved for closing.

- Works with the internal insurance specialist to ensure that insurance requirements are met by the borrower, including hazard, liability, and flood insurance where applicable.

- Coordinates with the accounting team for loan disbursement, ensuring funds are released in accordance with the loan agreement.

- Reviews and approves final settlement statements to ensure that fees and loan proceeds are accurately reflected.

- Manages escrow funding arrangements and ensures a smooth flow of funds at closing.

- Addresses last-minute changes or updates to ensure the loan closes on time.

- Ensures the proper recording of legal documents with relevant state or county offices, such as mortgages or deeds of trust.

- Facilitates the collection and organization of post-closing documents (title policies, insurance certificates, recorded documents).

- Tracks and reports on outstanding post-closing requirements.

- Proactively identifies potential issues or delays during the closing process and works to resolve them quickly.

- Maintains strong relationships with borrowers, attorneys, and third parties to ensure a positive closing experience.

- Assists the BDOs and underwriters in managing client expectations and addressing any concerns regarding the closing process.

- Ensures that the closing process complies with all federal, state, and local regulations.

- Ensures all transactions meet Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

Required Education and Experience/Skills:

- Candidates with prior credit union, community, regional or national bank experience in relationship management, business development or sales will be given priority.

- Bachelor’s degree in finance, real estate, business administration or related field is preferred.

- Courses or certifications in commercial real estate finance, mortgage banking, or legal studies related to real estate are an added advantage.

- 5+ years of experience in commercial real estate loan closings or a related field (such as real estate law, title, or escrow services).

- Familiarity with commercial real estate transactions, including acquisition loans, refinancing, bridge loans, or construction loans required.

- Thorough understanding of business financial statements, business and personal tax returns and credit required; and ability to prepare proposals and credit summaries for management review.

- Experience working with external legal counsel, title companies, and third-party vendors like appraisers and surveyors.

- Knowledge of loan documentation (e.g., promissory notes, deeds of trust, mortgages) and related legal and regulatory requirements.

- Familiarity with due diligence processes, including title searches, appraisals, environmental reports, and insurance reviews.

- Understanding of local, state, and federal laws related to commercial real estate transactions.

- Experience with document management systems and the ability to manage digital workflows.

- Excellent communication skills, both verbal and written, to liaise effectively between internal teams, external counsel, borrowers, and third parties.

- Strong relationship management skills to build rapport with borrowers and stakeholders.

- Ability to explain complex legal or financial concepts to non-experts in a clear and concise manner.

- Strong attention to detail in reviewing documents, reports, and closing checklists.

- Ability to multi-task and manage multiple closings simultaneously, often with tight deadlines.

- Well-developed problem-solving skills to address closing issues or resolve discrepancies efficiently.

- Ability to interpret financial documents, appraisals, and legal agreements to ensure that all closing conditions are met.

- Analytical thinking to identify potential risks or issues in the closing process and proactively address them.

Desired Characteristics

- Positive and professional attitude.

- Self-motivated.

- Team oriented, demonstrates a willingness to assist other members of the company.

- Detail-oriented with the ability to spot inconsistencies or issues in legal and financial documents.

- Adaptability and flexibility, given the dynamic nature of real estate transactions where issues may arise unexpectedly.

What we have to offer

- Competitive salary and benefits package

- Ample opportunities for growth and self-development

- Opportunities for professional development and advancement

- Collaborative and inclusive work environment with international exposure

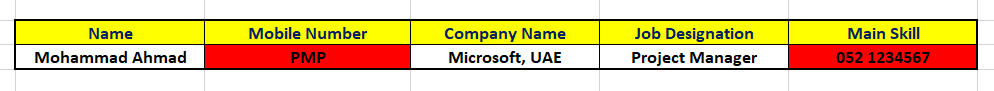

DETAILS TO REGISTER FOR THIS JOB:

NOTE: Apply to this job with an ATS-friendly CV!

https://avanacompanies.hrmdirect.com/employment/view.php?req=3249867&jbsrc=1014&location=f07a1d8c-e54e-bbcd-b773-e687f00dabb2NOTE: Apply to this job with an ATS-friendly CV!

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

What is an ATS CV?

Applicant Tracking System or "ATS", is the software that 'READS' your CV and stores this information in a database. Like this:

If the CV is not made as per the RULES of the ATS, the information will get messed up in the database. Like this:

And, you may never be found by the recruiter, in spite of your 'CV information' existing in the database...

... And, you'll wonder why you get rejected in spite of being a PERFECT MATCH for the Job.

Entry Level (0 - 2 Years Career Experience)

Junior Professional Level (2 - 5 Years Career Experience)

Mid Level Professional (5 - 8 Years Career Experience)

Senior Professional Level (8 - 40 Years Career Experience)

Executive Level (C-Level, MD, VP, Director, Lawyer, Doctor, Investor, etc.)

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

We've all heard we need to ”tweak the CV” to match the 'job vacancy’.

BUT, no one showed us how to actually do it.

Till Now!

Applying with a generic resumé/CV, does not work, as the Applicant Tracking Software removes non-matching resumé/CV's from the queue of candidates to call for an interview.

If you are willing 'TO DO WHAT IT TAKES' (Lionify!), then follow 'The Process' given below.

Else, close this website, continue doom-scrolling on your phone, and curse everything/everyone for your failure to find a good job.

You know you're talented and skilled, BUT, it takes effort to search and apply for jobs that will take you to the NEXT LEVEL.

Make up your MIND to FOLLOW The 4-step Process, where our deep expertise in crafting ATS-compliant resumes, and the POWER of AI will create the BEST ATS-friendly resumé/CV.

Our 27+ years of expertise in designing CV’s + the Power of AI together help you in your quest to Lionify.

So, what is the Meaning of Lionify?

To Do Everything it takes…to find your DREAM JOB.

Navigate here: https://lionify.ai/

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Read the recommendations our customers have given us, on my LinkedIn profile.

https://www.linkedin.com/in/shabbirfkagalwala/details/recommendations/

Navigate here for more testimonials/feedback about our expertise and results:

www.dubai-forever.com/resume-writing-feedback.html

www.dubai-forever.com/cv-writing-reviews.html

Also, read reviews about "www.Dubai-Forever.Com" on TrustPilot.com, the world's must trusted review site...

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Navigate here for the Latest CV Samples & Templates, APPROVED by recruiters. For FREE!:

https://www.dubai-forever.com/cv-writing-sample.html

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Join the Fastest Growing Job Group on LinkedIn:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Join the Middle East's Best Job Groups on Whatsapp:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Join our Telegram Group:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

Submit your CV here, as well:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

We support the Far-Sighted, Growth-Oriented Vision announced by the UAE, Saudi Arabia, Qatar, Oman, Kuwait and Bahrain.

It's an exciting time and the next 30 - 40 years will see massive growth in jobs in the GCC countries.

Excited about working in the GCC? Click on one of the banner's below...

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇦🇪 🇸🇦 🇶🇦 🇴🇲

SOCIAL INITIATIVE:

We publish job vacancies on this Job Portal (https://www.dubai-jobs.me) and our Whatsapp groups (www.dubai-forever.com/whatsapp-jobs.html) for the benefit of job-seekers.

It is to help people who are searching for jobs from across the world.

This is a Social Initiative from our team @ dubai-forever.com, so please help us in this Noble Task by Forwarding these jobs within your Network.

Do this GOOD DEED.

You never know who will benefit from it.

You've heard about KARMA right?

It's waiting to give you 10X of whatever you do...Do the Good Deed. NOW!

No comments:

Post a Comment