MAIN PURPOSE

The Senior Accountant (Tax, Master Data, Audit, and Compliance) primary role will be responsible for Direct Tax handling, filling, and documentation. Also, to support and backup for Indirect Tax, Master Data management, Audit, and Compliance for all middle east entities

KEY RESPONSIBILITIES

A technically knowledgeable individual who has a good business understanding and can make balanced decisions whilst complying with tax rules and regulations. Excellent communication skills and an ability to work collaboratively with Shared Service, internal and external tax advisors, and government bodies.

Corporate Tax Business Partner

Responsibility for the preparation of annual corporate tax returns for all three UAE entities (End to End process)

Work with external tax auditors & advisors on query resolution to achieve final corporate tax computation

Support the tax manager/tax agent in obtaining relevant supporting documentation for the tax return.

Updating company records in the FTA portal whenever required.

Maintaining, and tracking all documentation required for the tax year. I.e., relevant invoices for deductions or relevant add-backs.

Assisting the auditors with any corporate tax-related queries

Flag and update if any Tax Local regulation changes, maintain Tax master data as required and identify training needs, and organizes training or facilitate access to

training materials for building capability

Actively involved in Tax related metrics reporting review to enable timely corrective

actions and future process improvement

Ensure tax-specific guidance and support to non-tax specialists’ operational roles

such as procurement, logistics, and accounting.

Ensure transfer pricing documentation is available and maintained up to date also document all no existing contracts that are required for Tax purposes.

Preparation of quarterly US GAAP corporate reports such as FIN48, and tax payable analysis.

Ensure smooth Tax audit and year-end process.

Be a Single point of contact (SPOC) for Tax audits, coordinating efforts between various providers:

Local Tax advisors

Shared service center (VAT team, GL teams)

Tax organization for strategy alignment and Transfer pricing defense

Provide Tax related forecasts to the treasury team

Corporate Tax Implementation

Act as a SPOC for project-related requirements and communications.

Support the tax advisors in obtaining the relevant information for the corporation tax implementation project.

Establishing and updating company records in the FTA portal

Research and analyze tax, the latest tax legislation released by FTA and work closely with tax agents on the implications to our entities

Analyze the impact on the local entities with corporate tax implementation

Providing regular updates to the management on the project

Customer Master Data & Pricing (Backup)

Managing the customer master data including but not limited to customer creation (Sold to, Shipped to, and Payer account), brand listing, retail margin, credit limit, and Hierarchy setup for all three UAE entities and for KSA

Blocking and unblocking customer accounts, payment terms changes, setting up discounts, and any other required to set up in the customer accounts.

Customer Master Data clean-up on a monthly or quarterly basis as per the Global requirements.

Managing of updating prices promptly.

Troubleshooting any issues raised and overseeing any UAT testing requirements related to prices.

Responsible for the non-saleable prices computation and updating the same in SAP.

Managing and updating the cost of inventory materials under our local plants in coordination with Supply Chain, Marketing, and corporate teams.

Governance, Risk, Compliance (GRC) (Backup)

Responsible for all request which relates to SAP access, GL, Cost center & Profit Center creation, and changes for all three UAE entities and for KSA

VAT (Backup)

Take full ownership of the monthly VAT filing as a backup for CME and CDE and quarterly VAT filling for CRT as per local guidelines.

Work closely with AP / AR / Intercompany / Commercials (SSC and local teams) and Customer Service team for the monthly VAT requirements.

Monthly review and reconciliation of VAT files before submission for approval to management

Ensure all updates from the government on VAT are shared with the concerned team members regularly.

Work with external tax auditors & advisors on query resolution to achieve final VAT computation

Analysis of tax audit findings and implementing processes are changed in a way the issue does not re-occur

Work actively with Tax Agents to make sure all local entities are tax compliant.

Updating company records in the FTA portal whenever required.

Be a Single point of contact (SPOC) for VAT Tax audits

Accounts Payable (Backup)

Support to prepare manual payments in the banking platform when needed

Coordinate on all payments with SSC and signatories (end to end)

Support if required for netting payments (monitor the process from uploading of Intercompany open items in BMG portal to final settlement)

Coordinate with SSC & Business in this regard and provide required support to both parties

Auditing and control

Based on the given scope, ensure that all comply with SOX and Standard Operating Procedures

Assist Audit Manager in all types of Local and Global audits as and when required.

Perform testing of controls periodically and liaise with the auditors during the audit on the above scope.

Ensure all filing is maintained as per audit requirements.

Projects

Participate and support any ad hoc projects from time to time given by management

Apply For This Job Using a Branded ATS-compliant CV from Dubai-Forever.Com.

What is an ATS CV?

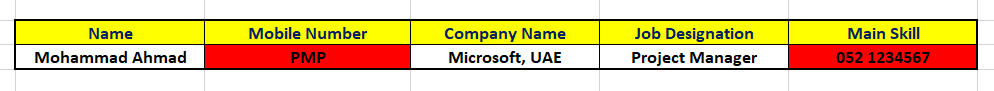

Applicant Tracking System or "ATS", is the software that 'READS' your CV and stores this information in a database. Like this:

If the CV is not made as per the RULES of the ATS, the information will get messed up in the database. Like this:

And, you may never be found by the recruiter, in spite of your 'CV information' existing in the database...

...And, you'll keep wondering why you get rejected in spite of being a PERFECT MATCH for the Job.

Read more about the ATS CV:

https://www.dubai-forever.com/cv-writing-services.html#ATS-Compliant-CV

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

What's the most IMPORTANT thing you should read about a CV Writing Service?

Client Satisfaction Reviews, right?

You'll get a fair idea whether to purchase that service or not.

Read the recommendations our customers have written on my LinkedIn profile.

Click the LinkedIn banner below and then scroll down to the Recommendations section.

Navigate here for more testimonials/feedback about our expertise and results:

www.dubai-forever.com/resume-writing-feedback.html

www.dubai-forever.com/cv-writing-reviews.html

Also, read reviews about "www.Dubai-Forever.Com" on TrustPilot.com, the world's must trusted review site...

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

Want CV Samples & Templates for FREE?

Click on the CV's below to begin:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

Join the Middle East's Best Job Groups on Whatsapp:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

Join the Fastest Growing Jobs Group on LinkedIn:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

Join our Telegram Group:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

Submit your CV here, as well:

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

We support the Far-Sighted, Growth Oriented Vision announced by the UAE, Saudi Arabia, Qatar, Oman, Kuwait and Bahrain.

It's an exciting time and the next 30 - 40 years will be those of the GCC countries.

Excited about working in the GCC? Click on one of the banner's below...

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

SOCIAL INITIATIVE:

We publish job vacancies on this website and our Whatsapp groups for the benefit of job-seekers.

It is to help people who are searching for jobs from across the world.

This is a Social Initiative from our team @ dubai-forever.com, so please help us in this Noble Task by Forwarding these jobs within your network.

Do this GOOD DEED.

You never know who will benefit from it.

You've heard about KARMA right?

It's waiting to give you 10X of whatever you do...Do the Good Deed. NOW!

🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭 🇰🇼 🇦🇪 🇸🇦 🇶🇦 🇴🇲 🇧🇭

No comments:

Post a Comment